Swatch Group’s 2017 Results Show Strong Growth (and some Baselworld 2018 novelties partially revealed)

Strong Growth, Better Profitability and Positive Outlook for 2018.

After Richemont announced strong quarterly results just before SIHH 2018 and LVMH reported double-digit growth for 2017, it’s now Swatch Group’s turn to disclose its annual results for the year 2017. And before going into details, know that the Group is strong and that the outlook for 2018 is still very positive. Once again, the industry seems to be in full recovery, with one or two threats that will have to be managed in the near future though.

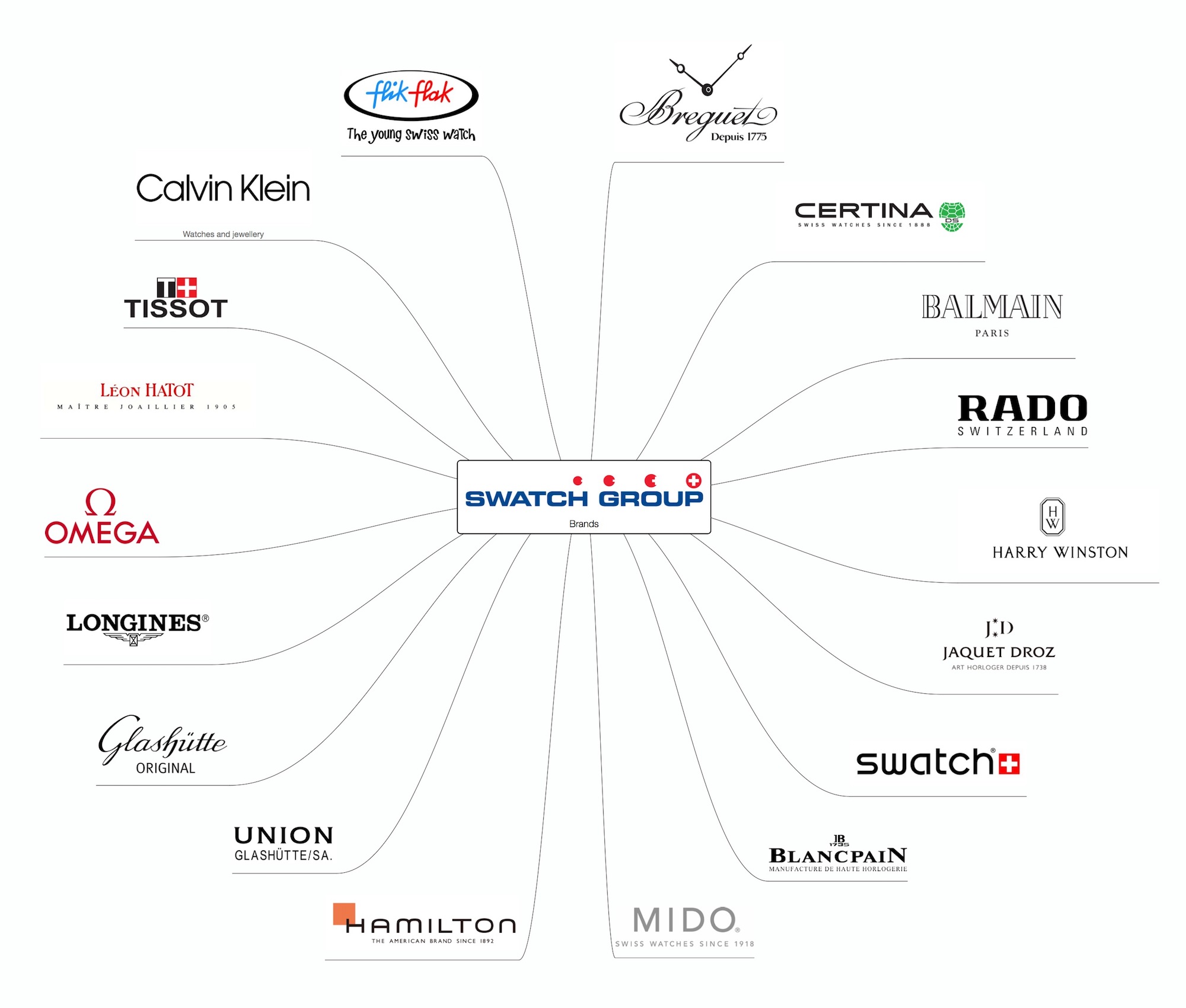

Swatch Group, one of the largest Watches & Jewelry conglomerate – owner, among others, of Swatch, Omega, Breguet, Blancpain, Jaquet Droz, Glashütte Original, Longines, Tissot or Rado – just published its yearly report, posting strong results for the year 2017. First of all, net sales increased 5.8% to CHF 7,989 million and +5.4% to CHF 7,960 million at current exchange rates (vs. CHF 7,553 million in 2016). Growth is driven mainly by the Watches & Jewelry segment, with an overall growth of 6.9% at current exchange rates (remember that this segment is responsible for over 90% of the group’s sales).

Profitability, a factor even more important than sales, is even stronger, with an operating result jumping 24.5% – the operating result represents 12.6% of the sales in 2017 vs. 10.7% of the sales in 2016. The net income follows the same trend with a growth of 27.3%. Overall, all indicators are positive, both for the sales and profitability of the Swatch Group.

Looking at the report in detail, we can see a strong acceleration of 12.2% at current exchange rates in the second half of the year and in the 4th quarter even 14.9% in the Watches & Jewelry segment. The month of December recorded the second best monthly sales in the history of Swatch Group. As for the segments, prestige and luxury (Omega, Breguet, Blancpain, JD and GO) recorded the strongest increase, while the basic and middle range price segment, with Flik Flak, Swatch, Calvin Klein, Hamilton, Mido and Tissot, recorded good growth in value as well as in volumes (if the Swatch Group doesn’t mention numbers here, we can imagine that the growth was less impressive in this segment).

As for regions, growth is mainly driven, once again, by Asia / Pacific. We’ve seen the exact same trend for both the Richemont Group and LVMH. While being a positive outlook in the short-term, this predominance of Asia in sales and growth remains dangerous, knowing how volatile this market can be – remember that the decline of sales in Asia was the main reason for the industry’s recession in 2015/2016.

As for 2018, the Swatch Group expects further very positive growth in local currencies. Tissot is now doing over CHF 1 billion in sales, while Longines is on its way to CHF 2 billion in sales (in the medium term).

Some Baselworld 2018 novelties partially revealed…

In the report, the Swatch Group mentions that “Omega will also celebrate the 70th anniversary of the Seamaster and the 25th anniversary of the Seamaster Diver 300m in 2018, and will market special editions of the collections for these occasions.” or “Breguet, with its new Marine Collection“… You know what to expect for Baselworld 2018.